Negotiating term sheets are tough. It’s even harder when we don’t fully understand the motivations of the other party. In this Chapter 3 of our Founder Tip Series, we are sharing a few thoughts on the main parts of a venture term sheet, why they matter, and what’s the current market standard.

When a company has a priced round, they typically will have a set of financing documents which include the Share Purchase Agreement (details the valuation, investors, closing conditions etc.), Articles of Incorporation (main document governing the company’s activities and how decisions are made), Investors Right Agreement (includes rights which are given to the investors), Voting Agreement (governs how decisions are made), and ROFR / Co-sale agreement (governs insider sales and purchases). These documents are essentially longer formats of details mentioned in the venture term sheet.

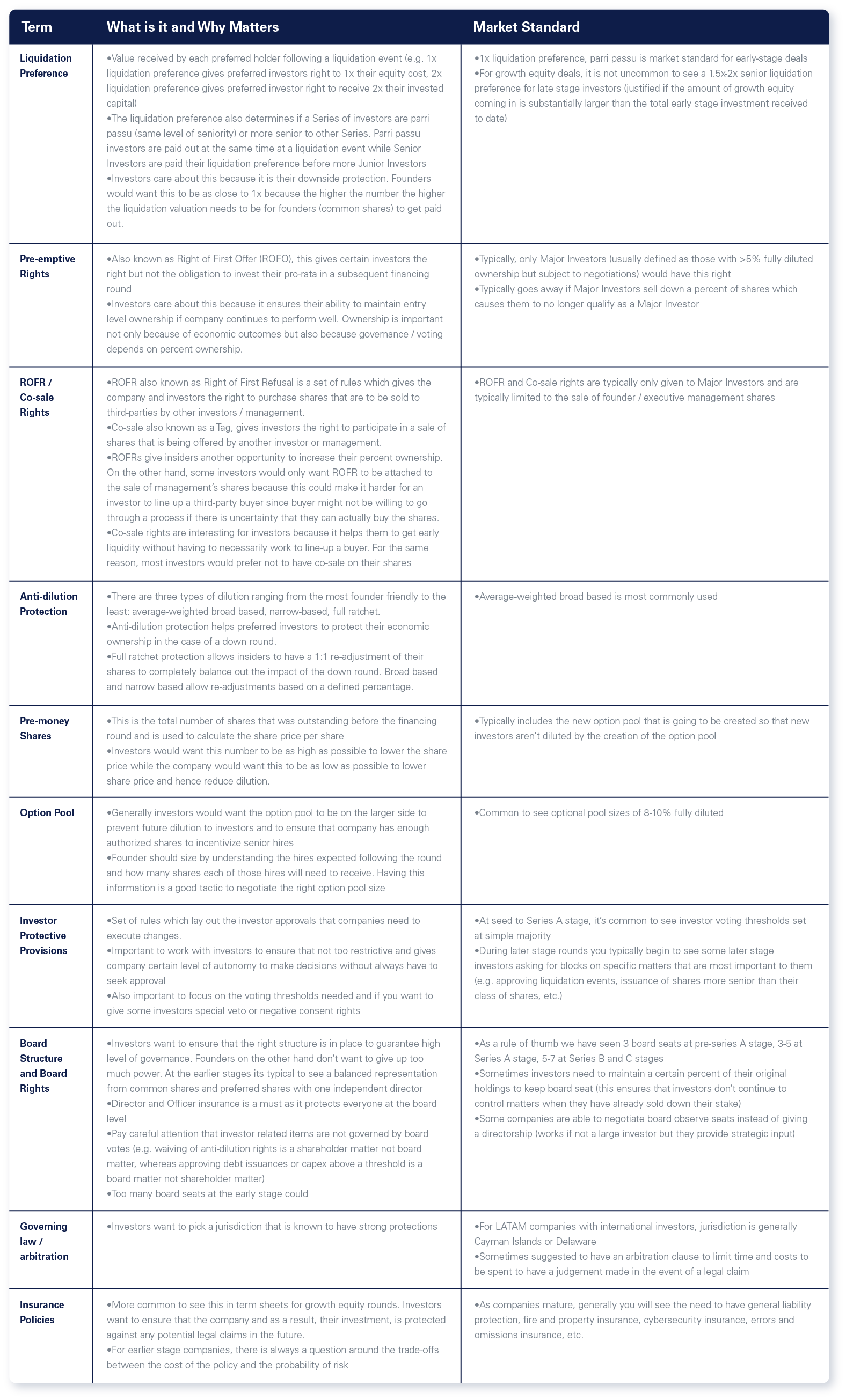

Below, we have outlined some of the most important terms sheet items which would essentially be used to draft the full suite of financing documents. Remember, that you should always consult with your legal counsel before agreeing to any terms.

Disclaimer: The information presented above is strictly for conversational purposes. It is not legal advice and we recommend to consult legal counsel before taking action on anything mentioned in this blog.