First, a couple of facts:

In Mexico, 33% of the population lives on less than US$5 per day, and 44% of the population lives under the poverty line. This is true despite Mexico being ranked as one of the top 15 richest countries in the world. These eye-opening figures help explain why Mexico is the third largest recipient of remittances. In 2022, Mexico received over US$60 billion in remittances, where 99% where done through electronic transfers, 96% coming from the United States and 82% were paid in non-banking institutions. This large amount averages a number of 12.7M transactions sent from the US to Mexico through out the year with an average ticket of US$300.

These transfers partly went to support some of the most vulnerable communities, where 1.6 million Mexican households depend on remittances as their sole source of income. Without this vital inflow of capital, mothers would not be able to feed their families, ambitious children would not be able to go to school, and communities would not have access to certain fundamental rights such as the right to effective healthcare.

Positive Tailwinds

- Fast Growth: US-to-LatAm remittances growing 11% YoY since 2014, and remittance flows now exceed Foreign Direct Investment

- Digitalization: Adoption of digital platforms is growing in our market segment, and there is more price transparency

- Blockchain Accessibility: Crypto technology is now available for cross-border payments, lowering costs and speeding transactions

- Tailwinds from COVID-19: Recent events accelerate the adoption of less human-intensive processes, LatAm has achieved 90% of Smartphone penetration

Growth / CAGR: Because of the macroeconomic forces of globalization & migration, remittances have been growing 10% on average worldwide. CAGR of 10.4% since 2000

Felix Pago

Traditionally, Mexicans living in the United States have had far too few options to send money across the US-Mexican border. This includes international solutions such as Western Union and MoneyGram, as well as local players such as Elektra and Coppel (some of the largest retailers in the country). One thing that all these solutions have in common is that they are generally unfriendly for the user: no visibility in exchange rates, exorbitant fees (+$50), slow transfer processes, limited ability for digital transfers, and low tech impacting the user experience.

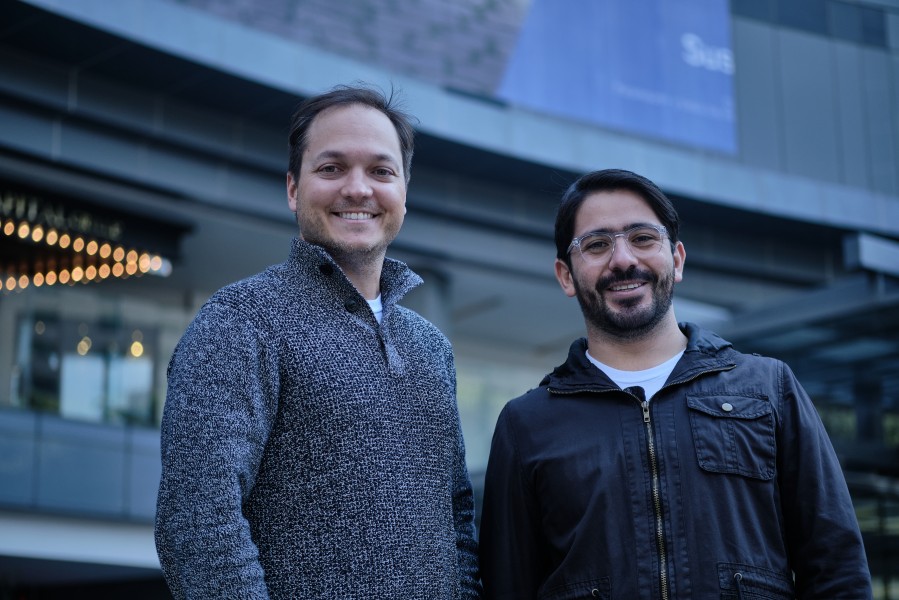

This is where our investment in Félix comes in. We had been spending some time studying the international remittance market in India, China, and the Philippines, and realized that there were a great deal of similarities between the market trends which propelled several Asian startups to excel, and trends that are present in Mexico. When we first met Bernardo Garcia and Manuel Godoy, co-founders of Félix, we were immediately impressed with their understanding of what was broken in the current Mexican remittance market and how thoughtful they were around how to build a better product. The solution that Bernardo’s and Manuel’s team built allows anyone from the US to send money to Mexico using an easy-to-use WhatsApp chatbot for a flat US$3.79 fee (at least 92% cheaper than competitors’ prices) with upfront knowledge of the exchange rate—something that competitors do not allow. Within minutes of interacting with the Félix WhatsApp chatbot, the sender is able to send money directly to the bank account of someone living in Mexico or allow them to pick up at one of several partnering brick-and-mortar locations. For us, the value proposition of Félix was and continues to be crystal clear: cheaper, faster international money transfer with no hidden fees and no surprises all in a superior customer interface

At HTwenty, we are proud to have invested in Félix’s pre-seed round and followed on on their Pre-A extension alongside investors such as Wollef, GFC and MELI. Since our investment in late 2021 the company has exhibited strong product-led growth and has quickly begun to scale across multiple markets in the United States and Latam countries. We invested in Félix not only because of its ability to positively impact returns for our investors, but also because of the impact the business can have on millions of families across Mexico who depend on remittances to make it to the next day.

Please visit Félix’s website to learn more about the first ever chatbot native remittance company.